Summary

- AT&T has lost touch with the rally of the broader stock market since March/April.

- The fears concerning AT&T financial stability were partly justified, but that should no longer be the case.

- Above all, they do not justify such a discount to the broader market.

- AT&T is currently extremely undervalued and offers a lot of value to investors.

Introduction

Before COVID-19 hit the world, AT&T's (NYSE:T) stock price was on the rise again. The market had calmed down a bit after the Warner takeover and the Elliott dispute and trusted the company to be on the right track. AT&T had also clearly exceeded expectations in the operating business before COVID-19. As a result, the company generated a cash flow of USD 29 billion in 2019 instead of the planned USD 26 billion. In total, the company has sold assets worth USD 29 billion to pay back the debt. And even in the traditionally weak first quarter of 2020, the company generated a free cash flow of USD 4 billion.

But COVID-19 broke this momentum. But from my point of view, this is not justified. AT&T is now one of the most underestimated dividend aristocrats in the town.

AT&T has underperformed

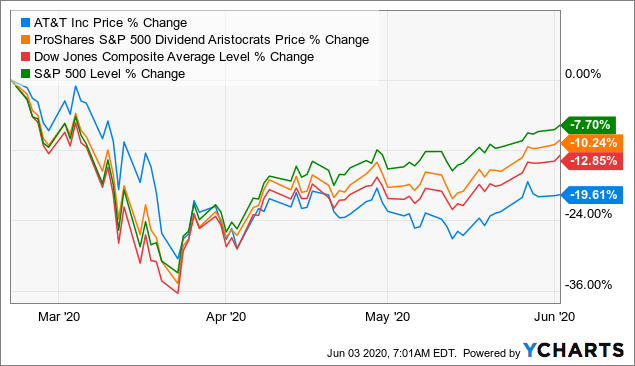

In the graph below, you can easily see what happened after the COVID-19 volatility erupted. Initially, AT&T stocks outperformed the market.

In March and April, however, conditions changed, and AT&T lost more and more ground. In the meantime, the share price development has completely decoupled itself from the broader market.

Data by YCharts

Data by YChartsCatalysts for the downfall

That AT&T lost momentum was due to several things. Once, investors feared that COVID-19 had adverse impacts on the advertising market. With the acquisition of Time Warner, AT&T became a content giant and had promising intentions to monetize the database with advertising. AT&T has strengthened itself here quite smartly with acquisitions and was able to offer both the platform for advertising and the marketing of advertisements. The position was so good that even Disney (NYSE:DIS) wanted to use AT&T's services. AT&T has established a unique situation here:

To reach consumers, an advertising company needs access to advertising spaces. [...] Advertising spaces are operated by the owner of these spaces or through third parties on behalf of the owner (e.g. an owner of a house offers a wall as an advertising space). So in a first step, operators and advertising companies must meet. For this purpose, automated platforms are used on the so-called "sell-side".

The other side is called "the buyer side". There, advertisers are looking for ways to reach the audience in the most effective way and are using so-called demand-side platforms. [...]

And here is the thing: AT&T offers services for both sides. On the buy-side, Xandr is making AT&T data available to buyers across all media types through AppNexus's demand-side platform (now called Xandr invest). On the other hand, the AppNexus Publisher sell-side platform allows the operator of advertising spaces to package inventory the way they want.

However, the individual regulatory measures taken by governments and the production stop of many companies led to a short-term slump in the advertising market volume. Many companies tried to remain liquid and cut their advertising budgets aggressively.

Besides, the extreme mountain of debt also weighs on the shoulders of the company. Suddenly, investors were once again worried that AT&T might not be able to pay back dividends and debt at the same time when the global economy is virtually at a standstill. The developments in the course of the COVID-19 crisis certainly justify a critical view of AT&T. At the peak of the COVID-19 crash, they also explained a loss in the value of AT&T shares.

Many investors also see that the launch of HBO Max has failed. So, there are no big lure offers like at Disney or Netflix (NFLX). AT&T also was unable to make HBO Max available via Roku and Amazon Fire (AMZN).