United Airlines' CEO Oscar Munoz

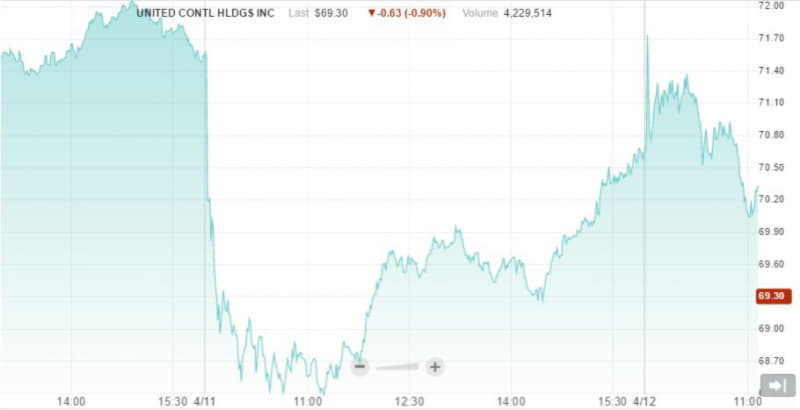

United Airlines (NYSE:UAL) took the biggest blow to its stock price not from removing a paid passenger off a flight to open seats for company employees but after its CEO defended a policy that allowed the customer to be bloodied and pulled off the plane against his will.

The public generally is forgiving if honest mistakes occur, apologies are given and corrective action is implemented to avoid a recurrence. But United Airlines and its leader initially followed none of those steps and the result is that the company lost roughly $950 million in market value in the wake of its self-inflicted public relations crisis.

The solution for the airline rests partly within its so-called “Customer Commitment” policy on its own corporate website, which promises to provide a level of service to customers that is commensurate with “a leader” in the airline industry.

“Our goal is to make every flight a positive experience for our customers,” the policy states.

The CEO should have asked himself whether that standard was met when he viewed the video of the passenger getting yanked out of his seat by Chicago airport police who were called by his employees to do so. Whether the bloody face of the doctor who was removed by force from his seat and dragged down the aisle out of the plane was caused by him falling on an armrest is secondary to the airline’s policy to pull him off the flight by force in the first place.

Try to imagine any other industry or business where customers are treated so poorly. Airlines have consolidated to the point in recent years where there is much less competition, higher prices and more crowded planes with a tightened number of seats. Indeed, United merged with Continental, American Airlines (Nasdaq:AAL) joined with USAirways and Delta Airlines (NYSE:DAL) purchased Northwest Airlines.

The airlines are not monopolies but they wield immense market power at their hub airports. New Jersey Gov. Chris Christie urged federal regulators after the incident to reform the airlines’ practices for “bumping” paid passengers off their flights in cases of overbooking and noted that United controls roughly 70 percent of the market at the airport in Newark.

To read the rest of the article about United Airlines’ Share Price Getting Slammed, click here.

Paul Dykewicz is the editorial director of Eagle Financial Publications, editor of StockInvestor.com and DividendInvestor, a columnist for Townhall and Townhall Finance, a commentator and the author of an inspirational book, “Holy Smokes! Golden Guidance from Notre Dame’s Championship Chaplain,” with a Foreword by legendary football coach Lou Holtz. Visit Paul’s website at www.holysmokesbook.com and follow him on Twitter @PaulDykewicz.